I am a current CASS Business school student second year

studying ‘Investment and Financial Risk Management’ who recently has undertaken

a module called ‘Portfolio Theory and Investment Valuation’. At first, I was

excited, a module which will help towards my goal of managing a portfolio of

stocks with a long-term investing thesis. Having read many investing books from

legends such as Peter Lynch, Warren Buffet and Benjamin Graham, I was excited

to delve further into the concepts I have learned about and seek to get a good

grade in my coursework and examination.

I was shocked when I walked into the class and was being

taught how to devise a portfolio solely on past price data. Using statistical

concepts such as standard deviation, beta and correlation to decide whether I

should invest my wealth into a business operation.

For some background knowledge, my thesis on stock investing

is based upon some core principals set out by the world’s greatest investors.

You are buying a portion of a business, so you should invest based on the

quality of a business model, the integrity of the management and their position

within their market place. You should seek stocks for your portfolio as if you

are a business analyst, as whilst stocks in the short term, they may not

correlate to the quality of the business and its earnings, in the long-run,

there is 100% correlation.

MPT took a drastically different view to the top investors

of our time. They seek a portfolio based on past price data of stocks having

little correlation with each other, having a small standard deviation (small

changes in the stock price relative to the stock market), and having a beta

relative to your specific risk preferences.

MPT takes a science approach to the stock market. It

believes in an efficient market, whereby all available information is related

to the stock market prices. Basically saying that you don’t need to understand

a single business principle to become a market wizard. In Lehman’s terms, if

you are of high mathematical competence and have no prior business knowledge or

experience, you can decide which business’ will do better than others. Something

which is clearly wrong.

Here are some horrifying assumptions that MPT makes.

- Asset returns are

normally distributed random variables

- Correlations between assets are fixed and

constant forever

- All investors aim to

maximize economic utility (in other words, to make as much money as possible,

regardless of any other considerations)

- All investors are rational and risk-averse

- All investors have

access to the same information at the same time

- Investors have an accurate conception of

possible returns

- There are no taxes or transaction costs

- All investors are price

takers, i.e., their actions do not influence prices

- Any investor can lend

and borrow an unlimited amount at the risk free rate of interest

The first is a biggy. Appreciation in the valuation of a

business operation, is a random statistic which is normally distributed. I find

it hard to even explain why this is wrong, as it is so very clearly stupid. In

this thesis, no matter what top business managers do, they could never escape

from the random chaos of their stock price and the stock variance. This

assumption also suggests that great investors such as John Templeton and Peter

Lynch are statistical anomalies and that despite their hard analysis of the

quality of management and business model, they became the rich by calling heads

on a coin toss more times than any other portfolio manager.

Another big problem I have with MPT is beta. For anyone that

hasn’t heard of this before, I will try to explain it in simple terms (Rather

than the Greek letter jargon that business school professors love).

Beta is a single figure placed on a business’ head, that tells the investor how risky the business is. It calculates this figure by assessing the movements of the business’ stock price in comparison to the stock market as a whole. If it moves more than the market, it is more risky, less and its less risky. Now this is a ridiculous way to measure risk, for two main reasons:

Beta is a single figure placed on a business’ head, that tells the investor how risky the business is. It calculates this figure by assessing the movements of the business’ stock price in comparison to the stock market as a whole. If it moves more than the market, it is more risky, less and its less risky. Now this is a ridiculous way to measure risk, for two main reasons:

1) Beta changes huge amounts

over a period of time. If a great business like apple was assessed 20 years

ago, it would have a specific beta based on historical data. Since then, it has

completely outperformed the market due to great innovation and exponentially

growing revenues. However due to this increased stock movement, beta will now be

larger. Labelling Apple now as a more risky business, because it has performed

better than its peers and gained greater market position.

2) Should a business’ stock

price irrationally move down with no change in the business fundamentals. This

will increase the stocks’ standard deviation, labelling it as more risky which

in turn means you should look to stay away from the stock. Therefore suggesting

that it would have been okay to buy the stock when it was valued higher because

of the low standard deviation, but is now too risky since the price has fallen

and is now much cheaper. Buffet would have the completely opposite opinion. He

would be buying at the depressed stock priced as opposed to the higher price.

To quote Warren Buffett:

“A stock that has dropped very sharply compared to the market, becomes ‘riskier’ at the lower price than it was at the higher price, that is how beta measures risk.”

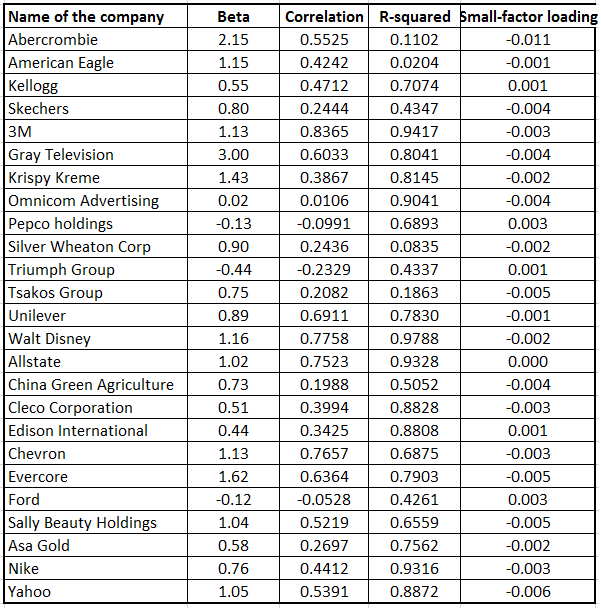

Here is an illustration of the research you should entail when devising a portfolio:

To quote Warren Buffett:

“A stock that has dropped very sharply compared to the market, becomes ‘riskier’ at the lower price than it was at the higher price, that is how beta measures risk.”

Here is an illustration of the research you should entail when devising a portfolio:

Ultimately I believe people looking to invest in the stock

market, should look at his/her investments as portions of a business. They

should look to invest in companies that they have knowledge about specifically

and stick to what the know. They should also ignore short term prices as they

do not reflect business performance, if they have good reason to believe that a

business is going to perform in the long term and then the share price falls,

they should look to buy some more. They should look for integrity in managers

and also in their economic moat.

This scientific rip off formula for investing in the stock

market will never make you rich in the long term and I will eat my words if in

50 years’ time I am recommending young wannabe investors, to read a book about

an investing legend that used the MPT thesis.

A fundamental principle that the teachers of MPT missed out

is that it is better to be approximately right than precisely wrong.

So here is my plea that business schools, including CASS

Business School should stop teaching this finance dogma and teach us more about

business fundamentals, sound analysis and forget the Greek alphabet.